Creative Financing allows the School District to borrow funds and not have to pay the full interest and principal reduction required according to a normal amortization schedule. This is a way to "kick the can down the road" and not deal with the true cost of renovations.

Kicking the can down the road always results in increased interest expenses. We don't need to hire a professional services firm to discover that. We do need to decide as a community if that is the right approach to use when we value renovation projects. From all the responses sent to the Board (that were made available to me), our community frowns on creative financing.

The most egregious type of creative financing is called a Capital Appreciation Bond (CAB). This type of bond is actually a series of zero coupon bonds that mature in different years and typically there are a number of years with no payments to a creditor (bond investor). Each year of maturity have different CUSIPs and could be sold to a different bond investor. For each year of maturity the School District repays the bond investor(s) the principal borrowed plus interest compounded for the number of years borrowed. In finance this is sometimes called a "bullet payment" referencing the expression a "bullet to the head".

For CABs, the School District pays the highest interest charge in the highest year of maturity. That's unlike a regular Current Interest Bond (CIB) which acts more like a fixed rate mortgage with interest charges decreasing over time.

Selling CABs to the debtor (taxpayer in a School District) is a hard sell and often the District is forced by circumstance into purchasing a CAB. This happens when the bond consultant doesn't talk about the total repayment costs for different bond types, doesn't talk about compound interest and tries to frame the selling of the bond as "no tax rate increase" or "will only cost an additional $20 per $100,000 assessed value" when a higher rate increase would have avoided using a CAB.

The new law passed by Governor Jerry Brown references "compound interest" 11 times in the legislative record.

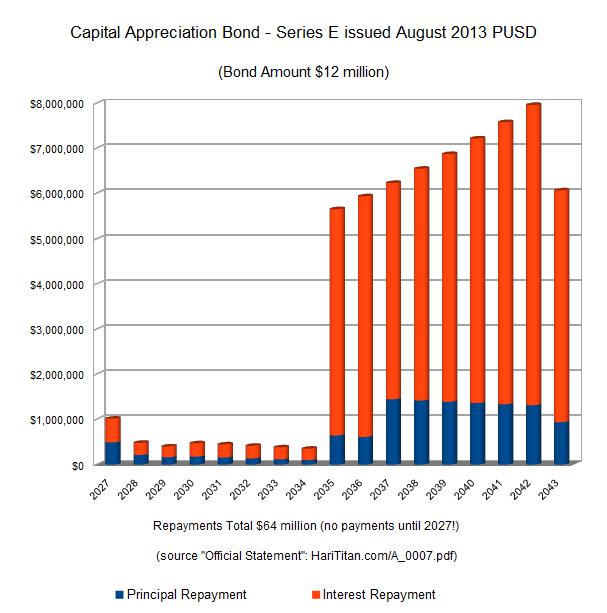

PUSD issued a couple of CABs during the 2006 Seismic series of bonds (series B and E). Series E was a loan / bond amount of $12 million that taxpayers have to pay $64 million (debt service side of property tax bill) over 30 years. That's $52 million in interest charges (433% of bond amount):

From the first graph you can see that interest charges grow as a function of the year of maturity. The data is based on the "Official Statement" for the Series E Capital Appreciation Bond: https://HariTitan.com/A_0007.pdf. The raw data for the graphs (https://HariTitan.com/SeriesE.pdf) is at: https://HariTitan.com/SeriesE.csv .

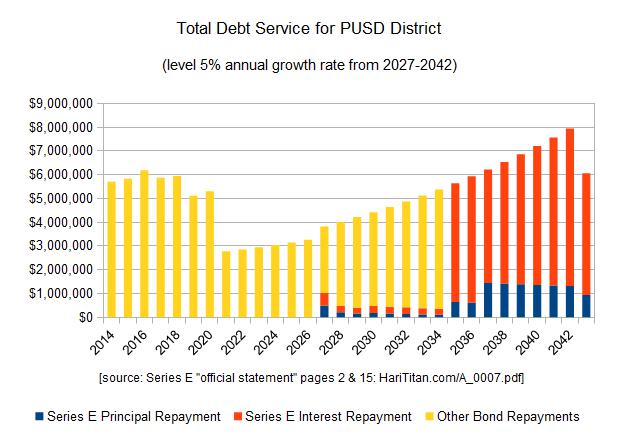

These graphics describe the major elements of a CAB - 1) no tax rate increase which means no payments to the creditor for a certain number of years; 2) this pushes repayments until after other debt is paid off and taxing capacity increases; 3) interest payments compound exponentially over time with bullet payments falling under the tax rate limits; 4) staying under the original tax rate forces the total repayment (maturity) further into the future.

The Series E bond in theory are subject to redemption (i.e. can be refinanced) in 2023. However the legal conditions to do so (like a $25 million bonding capacity) are unrealistic to hope for.

School Board member Andrea Swenson (ex Lehman Bros.) consulted Doug Ireland (ex Lehman Bros.) regarding the use of CABs.

The Piedmont bond consultant KNN Public Finance posted four alternative financing options for the Alan Harvey Theater bond. These proposals include a 15-year Capital Appreciation Bond (Option 1), 13-year and 25-year Current Interest Bonds (Options 2 & 3), and a 13-year Interest-only + CIB Hybrid (Option 4).

Our community pressure worked and KNN focused on lower total taxes (repayments) over the life of the bonds. Remember that the August 2013 CAB (Series E) had a repayment multiplier of 5.33. All KNN's new options have a multiplier below 2. The new CAB option achieved this feat with a 4 year tax holiday (compared to 13 years for the August CAB) and a 15 year term (compared to a 25 year term for the August CAB). KNN also changed the way the new CAB makes repayments, to be more level compared to the August CAB. This strategy is closer to the way my Bond comparison tool works: https://HariTitan.com/bond-tax-comparison.htm

Despite these improvements the CAB Option is still $6.8 million more expensive than CIB Option 2 for a $15 million bond. The Interest-only Hybrid is $2.5 million more expensive than CIB Option 2.

CIB Option 3 is a longer term debt designed to share the tax load over 25 years, which raises costs but keeps the tax increase lower.

Another important consideration against the CAB and Interest-only Options is that by ramping up payments to creditors in 2018 and 2020, they offset the expected tax drop when older bonds mature in those years. This uses up the District's future bond capacity and so takes away the power of a future School Board to fund future renovations (replacing Witter Field or upgrading science labs?) or to make other capital improvements that may become necessary by then.

The KNN presentation is:

http://www.piedmont.k12.ca.us/aboutpusd/agenda.minutes/2012_13/2014_Bond...

I have more background info on CABs:

https://HariTitan.com/bond-comparison.pdf (more detailed but using legal maximum)

The current School Board has indicated that it cannot impose any financing structure on the new Board. Therefore it matters who is elected to the new Board and if they have a taxpayer POV or an investment banker POV.

The Candidates were queried on their opinion on the use of Capital Appreciation Bonds versus Current Interest Bonds:

Doug Ireland: ...There are a variety of structures available to the Board in terms of interest rates, maturities and payment schedules. Until the requirements are established, it is premature to designate which form of payment is preferable...

Amal Smith: The bad press around CABs is from more recent use by school districts who have issued CABs with maturity dates as long as 40 years and with bond retirement costs as high as 10+ times the amount borrowed... recent legislation (AB 132) signed by Governor Brown that limits CABs to no more than 25 years and a maximum debt repayment ratio of 4-1.

Hari Titan: CABs should only be used if (1) CIBs are not an option for the required bond and (2) voters are told (as part of the bond measure disclosures) that a CAB may be used and what the total repayment amounts are expected to be

The full answers are available on the SmartVoter website: http://smartvoter.org/2014/02/04/ca/alm/race/1/questions.html