Delay would increase construction costs and reduce interest payments

An argument was made that voting NO on Measure H would delay the renovation or rebuild at the expense of increased construction costs in the future. These construction costs are claimed to be rising at 5% - 7% per year, compounded annually.

Measure H is financed with 6 years of interest-only payments (until 2020) followed by paying off the Measure H bond over 7 years for a total of 13 years of payments.

Delaying the bond issuance by 1 year (and correspondingly the start of construction) would save 1 year of interest-only payments prior to 2020.

If the interest rate is approximately 4% per year, that would significantly offset the increase in construction costs. [This math effect is not a simple subtraction!]

Proponents of voting NO on Measure H feel defeating the measure will force the District to reconsider a lower price on construction costs with either a tear-down and rebuild option (see http://harititan.com/article/costing-theater-rebuild ) or a series of smaller renovations. Either of these options could reduce costs further.

Delay would not increase interest rates

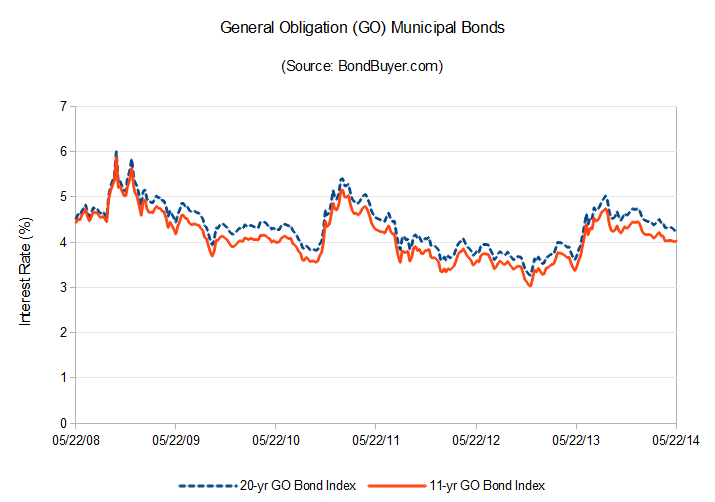

Another argument was made that voting NO on Measure H would allow interest rates to rise. We are currently in a low interest rate environment.

The vast majority of Piedmonters do not have Federal Reserve Chair Janet Yellen on their speed dial and have no inside information on the future direction of interest rates.

However as with other investments we can look at the recent price trend as a simple data-driven guide:

I don't see a clear upward trend in interest rates from this data. I actually see a small trend downwards since the last KNN presentation on January 22, 2014.

Many have reported this down trend in interest rates is due to the Federal Reserve reducing or "tapering" their bond buying activity.

A down trend in interest rates is good news for both the "YES on H" and "NO on H" campaigns.

Higher cost shared by higher tax base

KNN Public Finance is assuming a 3% increase in the total assessed valuation [not market valuation] for Piedmont. Current homeowners will only experience a 2% increase in assessed valuation (due to Prop 13) and the balance of the increase comes from long-time residents selling their homes.

Annual bond repayment costs are spread out over the total assessed valuation. In one year's time, a 3% higher construction cost leading to a 3% higher bond amount would not be noticed from a "tax rate per $100,000 assessed valuation" perspective.

A higher tax base is one of the drivers for higher construction costs. After all, construction projects must be perceived affordable by the community to keep those projects going.