The passage of Measure H1 is expected to trigger three bond issuances staggered 2 years apart in February of 2017, 2019 and 2021. In order to be able to pass Measure H1 with only 55% of the vote, the law requires that the combined tax impact of these bonds be less than $60 per $100,000 county assessed valuation (AV) subject to AV growth assumptions. The district is assuming overall assessed valuations are growing at 3.5% annually but if you are a current owner, Prop 13 will limit the growth of your assessed value to 2% per year. This AV growth rate compounds annually.

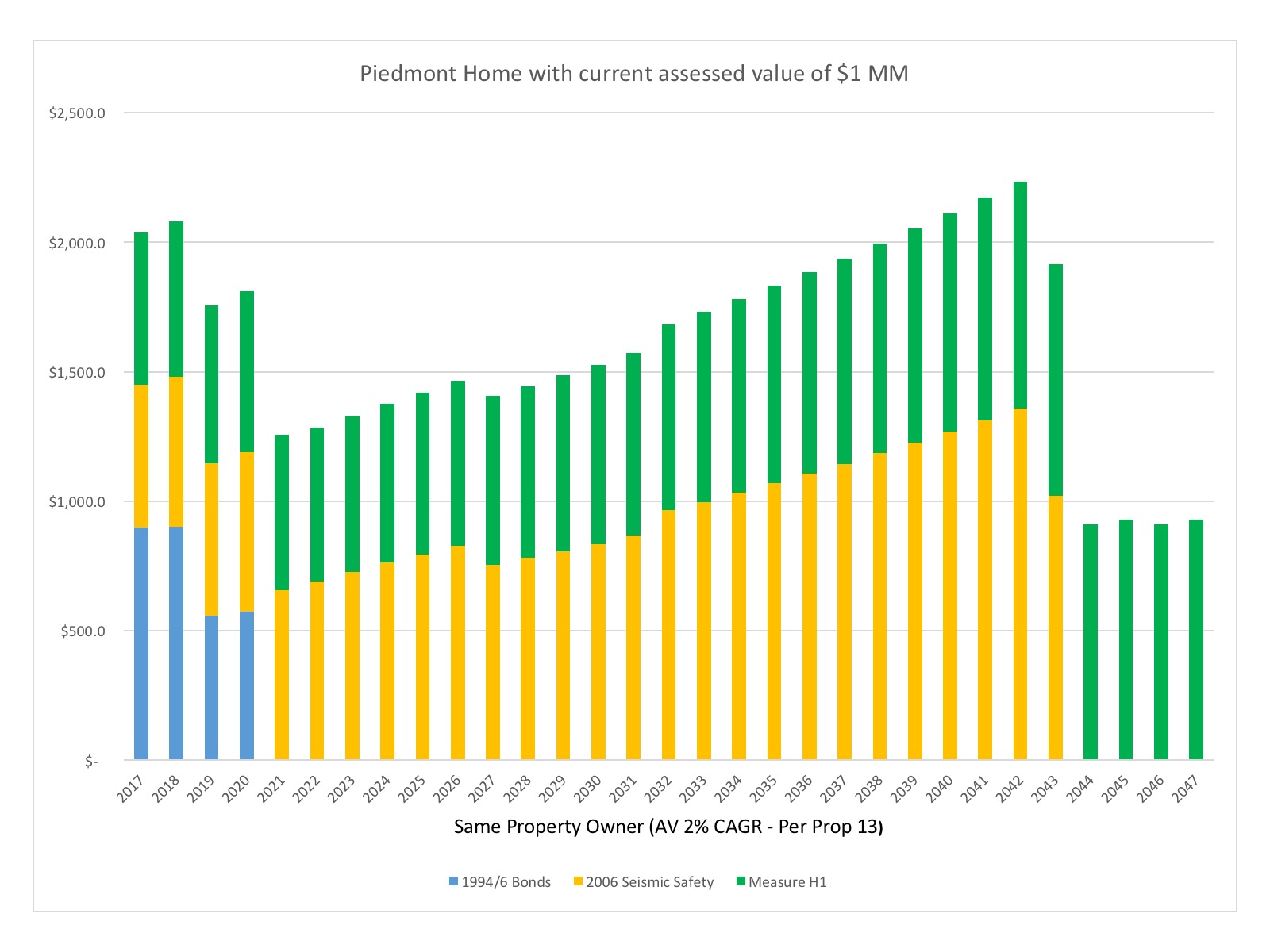

This year’s AV for the entire district is around $4 Billion. By 2047 when all three bonds are paid off, the district AV is expected to be $11.4 Billion. With roughly 4000 homes, the average AV is currently roughly $1 million. If we take a property that has an AV of $1 million today and apply Prop 13’s 2% annual growth rate, it will end up with an assessed value of $1.8 million by 2047. That home will start out paying $587 for Measure H1 in 2017 and this amount will increase to $929 in 2047 based on the higher $1.8 million AV. The total tax for this home would be $22,805 over the 31-year repayment period (2017 through 2047).

That's $2.02 / day (if your current county assessed value is $1 million)!!!

If we look at all debt service of prior bonds combined with Measure H1 (see Chart above), the new tax burden will be higher for years 2017 through 2020 but then will become even lower than what property owners are paying now until 2026.

All these numbers are scalable with your own county assessed valuation. For example if your AV is $700k, just multiply above numbers by 70%. If your AV is $1.3 million, multiply the above numbers by 1.3 or 130% etc.

More importantly, the chart above is scalable and has the same shape for every homeowner. The annual tax (Y-axis) will vary based on your current county assessed value (see property tax bill).

This analysis is subject to the following assumptions that can and will likely change over time:

- Homeowner doesn't sell or substantially improve their property

- Actual assessed value increases in the future

- Board issues bonds for the whole authorization of $66 million

- The market interest rates at the time of the bond issuances

- Potential refunding of the series in the future