CIB: Current Interest Bond. Works like a fixed-rate mortgage.

CAB: Capital Appreciation Bond. A series of Municipal Zero Coupon bonds with maturity dates in sequentially increasing years.

Bond buyers may mistake Municipal Zero Coupon bonds to be the same as Corporate Zero Coupon bonds.

From a bond buyer's point of view they both have rating agency reports from Moody's and Standard & Poors. Investing in either involves receiving principal and compound interest at maturity. The bonds can also be bought and sold in primary or secondary markets.

Their similarity pretty much ends there.

Corporate Zero Coupon Bonds

There are two types of parties involved in this transaction:

- The Corporation. Receives principal and invests it in the business and pays principal and interest at maturity. The corporation choses this option to limit cash flow obligations during the life of the bond but is well aware of the downside of interest charges compounding over the life of the bond. To mitigate this compounding effect, the Corporation will create a "sinking fund" that collects interest as it accrues and invests it back in the bond market. For example the sinking fund could be used to buy back the Corporation's own bond in the secondary bond market. Alternatively, the sinking fund could be designed to have the funds needed to pay off the bond at maturity. The latter approach allows the Corporation the flexibility to underpay its own sinking fund for a few years during hard times and then make catch-up payments.

- Bond buyers. Extreme due diligence is required to ensure the company has stable or growing cash flow and will remain in business until maturity of the bond.

Since taxpayers have no specific role in Corporate zeros, there is no applicable taxpayer point of view in this case.

Municipal Zero Coupon Bonds

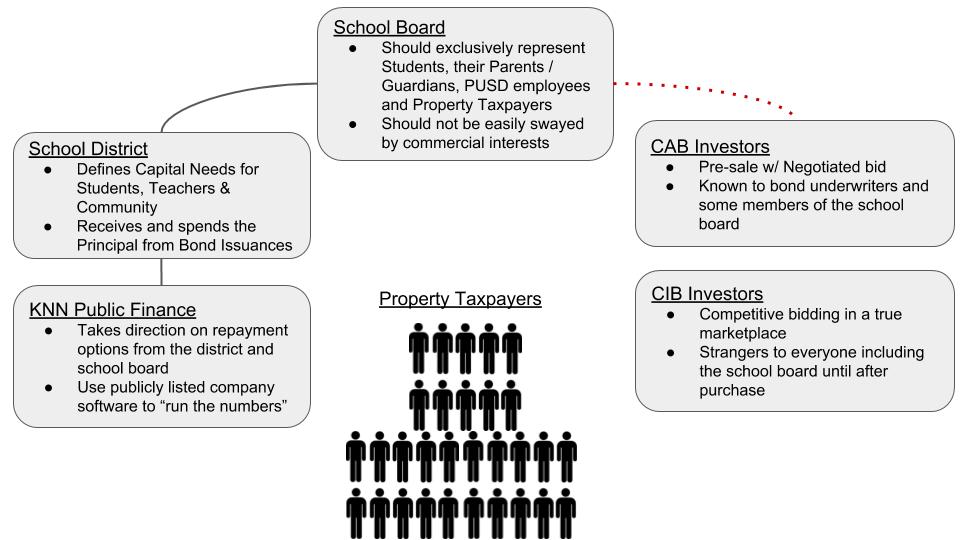

There are four types of parties involved in this transaction:

- The Municipality (e.g. City, County or School District). Makes a case for the bond and asks voters who live in the municipality for approval. If voters approve the bond, the municipality will receive proceeds from bond issuances up to the principal amount approved by the voters. The municipality will spend the proceeds as specified in the bond language and has the right to refinance (called refunding) the bond. A regular municipal bond can be converted to a municipal zero coupon bond as an administrative action during a refinance without the knowledge or second approval of the voters.

- Property Taxpayers. Owe principal and interest to pay off the bond at maturity in proportion to the assessed value of their property. The debt service line item of the property tax bill will not show any taxes due until maturity. Property tax bills are basically line item explanations of taxes owed this year and do not have a line item for deferred taxes. A property taxpayer has to make themselves aware if the municipality is deferring his/her taxes through the use of zero coupon bonds.

- Bond buyers. The interest paid at maturity is often tax-free. The bond is backed by the ability to pay for thousands of property taxpayers, however some municipalities have gone bankrupt.

- The County Tax Collector's Office. Will collect property taxes. Will use the debt service line item collection to pay bond investors with the help of companies like the Depository Trust Corp.

Each individual property taxpayer is responsible for their share of paying back the bond investors. If they wanted to mitigate the effects of compounding interest, the property taxpayers would each have to create their own sinking fund. Given that most property taxpayers would not be tracking each municipality's use of zero coupon bonds, creating appropriately sized sinking funds would be an impossible task.

Furthermore the annual taxes being deferred by each taxpayer are so small that they likely end up in checking accounts ready to be spent as opposed to being invested. This line of reasoning was discussed in an earlier article: https://harititan.com/article/defense-total-repayments

This leads to present value calculations that are typically used for Corporate Zero Coupon bonds to not be relevant for Municipal Zero Coupon bonds, see: https://harititan.com/Deceptive_Present_Value.pdf

The extreme effect of exponentially compounding interest can be seen in this article: https://harititan.com/bond-comparison.pdf

Summary

The federal government Treasury bonds also come in a zero coupon bond variety, called STRIPS, which many investors choose to invest in.

A property taxpayer could choose to invest in either a Corporate zero or a Treasury zero. Compound interest charges are due and payable to the investor, in this case the taxpayer.

However if a property taxpayer lives where they are required to repay a municipal zero coupon bond, the taxpayer is the opposite of a bond investor. In this case, compound interest charges are due and payable by the taxpayer to bond holders.

Investing in Corporate/Treasury zeros is the opposite of paying property taxes for Municipal zeros with respect to receiving versus owing compound interest charges.